5. Arowana Tokenomics

A. Introduction

Arowana tokens can be used as a monetary unit to join a platform service membership, use services, purchase, and receive rewards. Arowana tokens also support ecosystem distribution of partners.

Token Name : ArowanaToken (ARW)

Network : ERC-20

Total issuance : 500,000,000 ARW

Price : 1 ARW = US $ 0.04

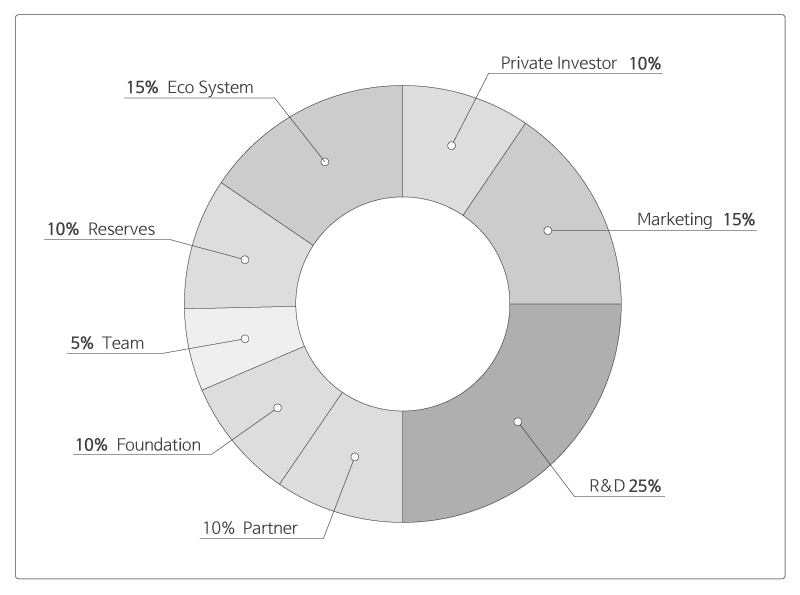

It divides existing foundation supplies into Reserves, Team, and Foundation, and reduces supplies of partners to operate Arowana tokens transparently. Furthermore, it makes new eco system supplies to create and expand an ecosystem and increases R&Ds to develop and operate new services.

B. Vesting Schedule

The vesting period is from 2 to 5 years, and the details are as follows.

Private Investor : The private investor's volume will be unlocked for 12 months at a rate of 8.33% every month from the first listing on the exchange.

Platform (R&D) : The duration of R&D is 30 months. The initial 5% of the volume was set to be unlocked in the first month of listing on the exchange, and 5% will be released for 19 months from the 12th month after listing.

Marketing : The marketing vesting period is 40 months. Marketing volume will be unlocked at a rate of 2.5% per month for 40 months from the first listing, excluding the initial 2.5%.

Ecosystem : Ecosystem's vesting period is set to unlock 3.33% for 30 months per month from the time 12 months have passed since the first listing. All lockups will be released 41 months after listing.

Partner : The partner's vesting period is 25 months, and the lock-up period is 18 months after listing. After 18 months of listing, the lockup will be released at a rate of 4% per month for 25 months.

Foundation & Team : Both Foundation and Team quantities will be locked up for 30 months after listing, and will be unlocked for 25 months at a rate of 4% per month from the 31st month.

Reserve : The reserve amount will be locked up for 35 months from the time of listing, and will be unlocked by 5% for 20 months from the 36th month.

C. Tokenomics

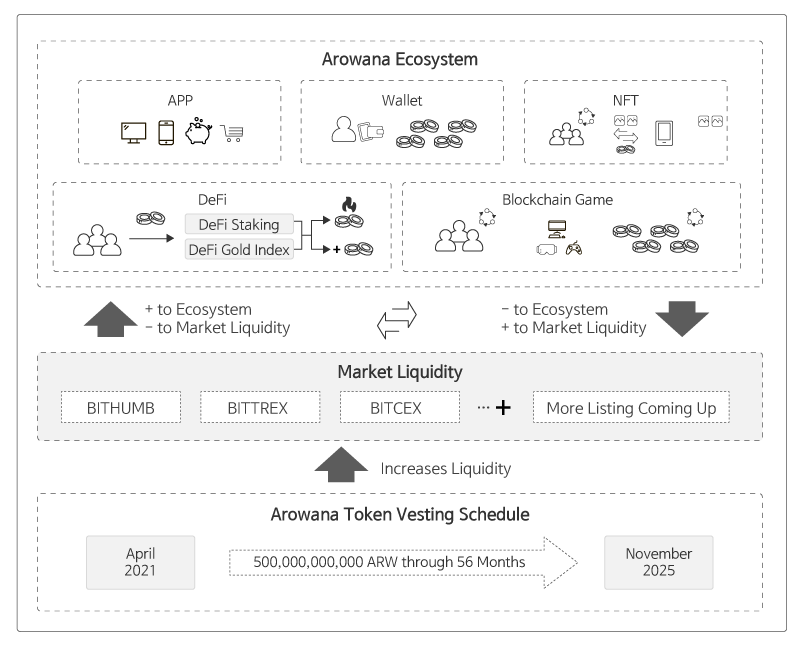

Arowana ecosystem affects the Arowana tokenomics with major governance functions. Each platform of Arowana ecosystem operates its own economic mechanism, which affects market liquidity to be either increased or decreased. The vesting schedule shows how liquidity will be infused into the market, however, the ecosystem will govern the liquidity through activating cyclical mechanism.

There are major factors that affect the price of Arowana token in the market, such as staking yield, NFT supply, platform fee, burn and airdrop of the tokens. Arowana project team utilizes each factor to stabilize the market liquidity and price of Arowana token at necessary moment.

Last updated